Some Known Incorrect Statements About Personal Loans copyright

Some Known Incorrect Statements About Personal Loans copyright

Blog Article

The Single Strategy To Use For Personal Loans copyright

Table of ContentsThe Buzz on Personal Loans copyrightThe Facts About Personal Loans copyright UncoveredPersonal Loans copyright Fundamentals ExplainedSome Known Questions About Personal Loans copyright.What Does Personal Loans copyright Do?

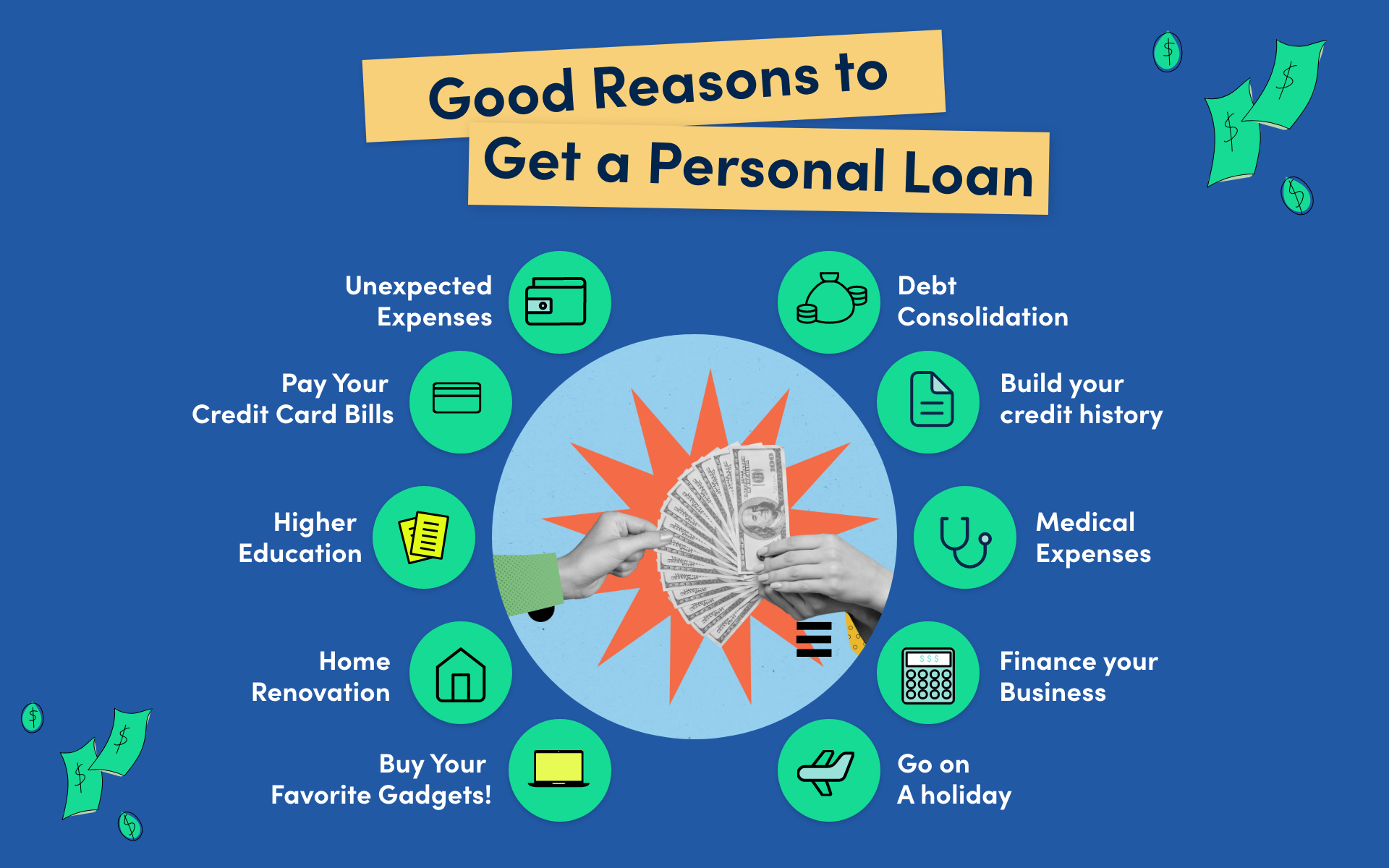

Let's dive right into what a personal loan in fact is (and what it's not), the reasons people utilize them, and just how you can cover those crazy emergency situation expenses without handling the worry of debt. A personal financing is a round figure of cash you can borrow for. well, virtually anything.That doesn't consist of obtaining $1,000 from your Uncle John to help you pay for Xmas provides or letting your roommate spot you for a couple months' rent. You should not do either of those points (for a variety of reasons), yet that's technically not an individual lending. Personal fundings are made via a real economic institutionlike a financial institution, cooperative credit union or online lending institution.

Allow's take a look at each so you can know precisely just how they workand why you do not need one. Ever.

Examine This Report on Personal Loans copyright

No issue how excellent your credit is, you'll still have to pay interest on most personal fundings. Safe personal finances, on the other hand, have some sort of collateral to "safeguard" the lending, like a boat, jewelry or RVjust to call a few.

You can additionally get a protected individual funding utilizing your auto as security. That's an unsafe move! You do not desire your main mode of transportation to and from job obtaining repo'ed because you're still spending for in 2014's kitchen remodel. Count on us, there's nothing safe and secure concerning guaranteed finances.

Simply because the payments are predictable, it does not mean this is an excellent offer. Personal Loans copyright. Like we stated before, you're virtually assured to pay passion on an individual loan. Simply do the math: You'll end up paying way extra in the long run by taking out a loan than if you would certainly just paid with cash

Getting The Personal Loans copyright To Work

And you're the fish holding on a line. An installation loan is an individual financing you pay back in fixed installations gradually (generally once a month) until from this source it's paid in complete - Personal Loans copyright. And don't miss this: You need to repay the original car loan quantity before you can borrow anything else

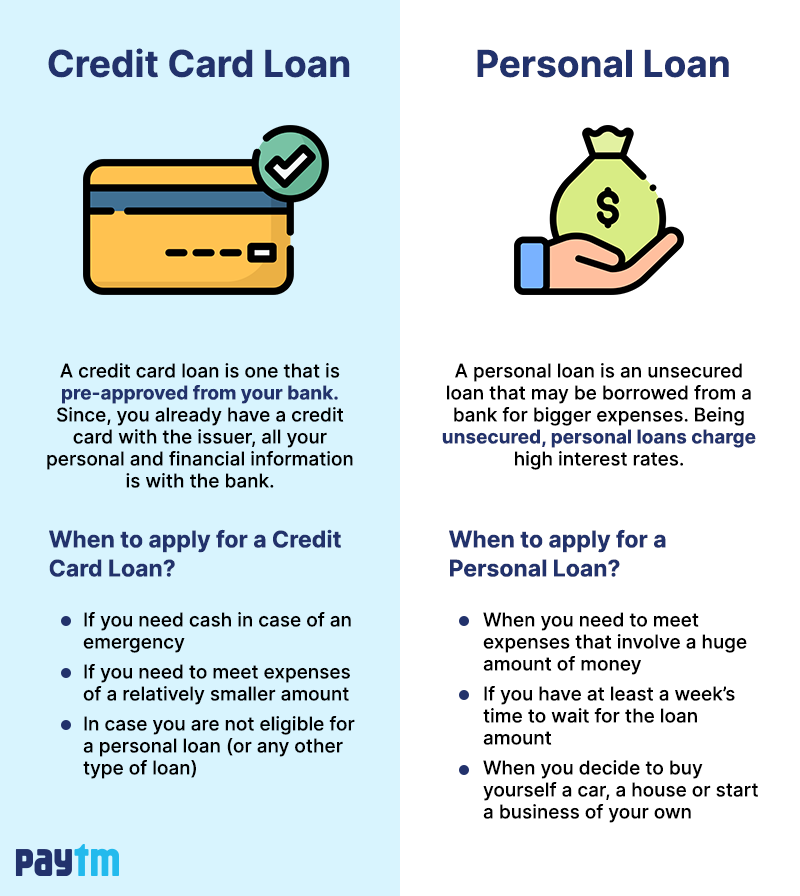

Don't be mistaken: This isn't the exact same as a credit score card. With individual lines of credit rating, you're paying interest on the loaneven if you pay on time.

This one obtains us provoked up. Since these businesses prey on people that can not pay their costs. Technically, these are short-term car loans that give you your income in advance.

The Facts About Personal Loans copyright Uncovered

Because points obtain real messy genuine fast when you miss a settlement. Those financial institutions will certainly come after your wonderful granny that cosigned the loan for you. Oh, and you need to never guarantee a lending for any person else either!

All that site you're actually doing is making use of brand-new debt to pay off old financial obligation (and prolonging your finance term). Business know that toowhich is exactly why so several of them use you combination fundings.

And it begins with not obtaining anymore cash. ever before. This is a great regulation of thumb for any financial acquisition. Whether you're assuming of taking out a personal funding to cover that kitchen area remodel or your overwhelming credit card bills. don't. Securing financial debt to spend for points isn't the way to go.

Personal Loans copyright Fundamentals Explained

The finest thing you can do for your monetary future is leave that buy-now-pay-later frame of mind and claim no to those spending impulses. And if you're taking into consideration a personal car loan to cover an emergency situation, we get it. Obtaining money to pay for an emergency only intensifies the stress and anxiety and hardship of the circumstance.

Report this page